- Dynamic, easy-to-follow animated visuals

- Crisp slides with engaging voice narration

- Hands-on, scenario-based interactive exercises

- Practical, real-world workplace examples

- Frequent learning validation moments

- A concluding assessment followed by certification

Learning Objectives

By the end of this course, learners will be able to:

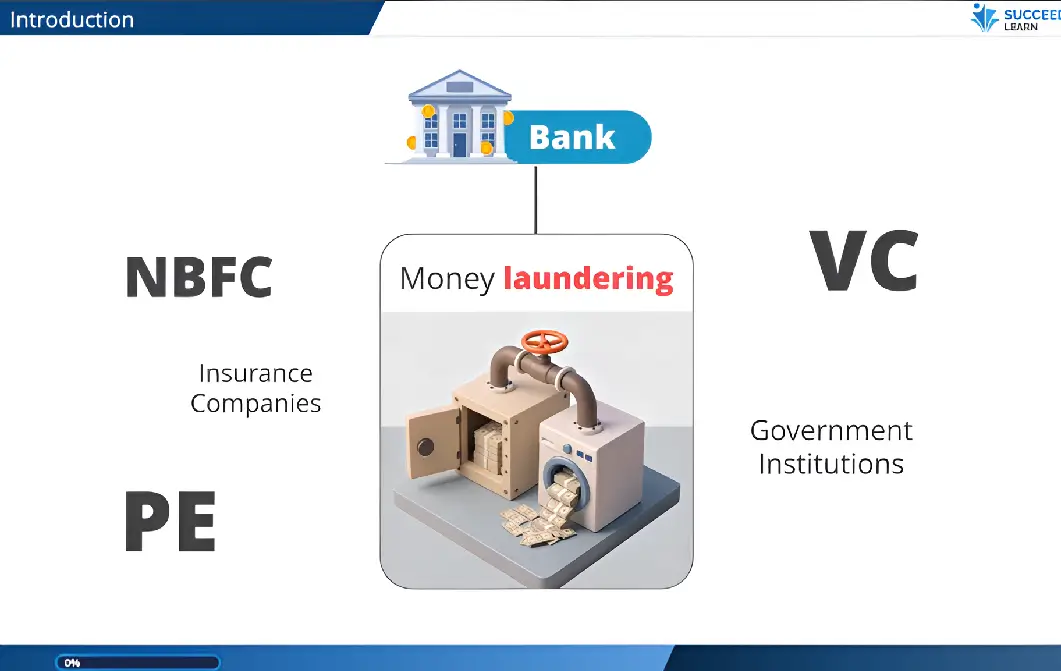

- Explain what money laundering is

- Define terrorist and proliferation financing

- Spot common red flags in financial activity

- Understand the laws and regulatory bodies

- Describe Know Your Customer (KYC) and due diligence requirements

- Apply a risk-based approach to AML obligations

- Report concerns and understand the consequence of non-compliance

Why Anti-Money Laundering (AML) Awareness eLearning Course?

Scenario-driven modules

Immerses employees in real-world situations Private Equity and Venture Capital Firms (PE/VC) face on a daily basis, (e.g., hidden UBOs, offshore flows, fast-tracked deals), helping them practice recognising red flags before they impact the firm.

Interactive decision-making

The course comes with exercises that allow learners to choose actions during simulated onboarding, due diligence, and escalation tasks thereby reinforcing correct behaviour through immediate feedback.

PE & VC firms face unique risks

The course sheds light on AML, CFT and CPF risks such as high-value transactions, layered deal structures, global fund flows, rapid onboarding, terrorist financing, proliferation financing, and dual-use technologies to ensure deals are paused, escalated appropriately and not approved without proper due-diligence.

Real-world case studies

The course walks through red flags in PE/VC, and real-world cases such as the Azerbaijani Laundromat and Danske Bank scandals show how easily illicit funds can move undetected without strong AML vigilance.

Strengthens organisational compliance

Teaches staff how to apply AML rules in day-to-day activities ensuring accurate KYC, proper due diligence, adherence to sanctions requirements, and correct reporting to the MLRO to prevent regulatory breaches and organisational and personal consequences, including multi-million-dollar fines, reputational collapse, loss of licenses, job termination, and even imprisonment of up to 14 years.

Frequent knowledge checks

The built-in knowledge checks after each major topic keep employees engaged while ensuring they can identify suspicious activity confidently and consistently.

Demonstrates that your org has undertaken compliance measures

The course allows structured, documented, and auditable training that clearly covers legal obligations, includes real-world risk scenarios, tests employee understanding, tracks completion on our LMS, and issues certificates, showing regulators that you have proactively equipped employees to identify, escalate, and prevent money-laundering risks.

Laws & Regulations Addressed in this Course

The course covers Anti-money laundering efforts in the UK and U.S. that are grounded in robust legislation designed to detect, prevent, and penalise financial crime. Major laws include:

| Legislation / Concept | Relevance in the Course |

|---|---|

UK

| The laws covered in the course are essential because they outline the firm’s legal obligations for managing financial crime risks and establish the required standards for KYC, due diligence, sanctions screening, and reporting. |

U.S.

| Under these laws, orgs must run effective AML programmes that verify customers, monitor transactions, conduct enhanced due diligence, and report suspicious activity to prevent money laundering and terrorist financing. |

Course Structure

Learning elements

Format & accessibility

The platform is fully responsive across desktop, tablet, and mobile, and includes a learner dashboard with progress tracking, automated reminders, and smooth integration with your existing systems.

Certificate

On successful completion and passing the assessment, learners can generate a completion certificate as proof of training (configurable per org).

Target Audience

The eLearning Course is tailored for:

- Frontline staff in sales, onboarding, and customer service

- Banking and financial services employees across all functions

- Teams in accounts, treasury and FinTech space

- Compliance, legal, and risk management professionals

- Senior managers and decision-makers overseeing AML controls

- Third-party agents, distributors, or partners operating under your compliance framework

In short for any employee handling financial transactions or customer data.

Case Studies: Real Consequences of Non-Compliance

The Anti-Money Laundering eLearning training is not universally mandatory for all orgs, but it is legally required for firms operating in sectors covered by anti-money laundering regulations. The orgs are required to maintain strong internal controls, meet client and partner expectations, prevent fraud and misuse of their systems, protect reputation and financial integrity to remain compliant and avoid any legal repercussions.

Below are real-world cases where companies were heavily penalised or suffered significant reputational damage due to AML compliance failures thereby demonstrating why robust AML awareness training is essential for orgs:

- HSBC was fined about US $1.9 billion in 2012 after major compliance failures allowed Mexican drug-cartel money to flow through its U.S. operations. The penalties stemmed from weak monitoring systems and inadequate employee training on identifying and reporting suspicious transactions.

- The UK regulator fined Deutsche Bank £163 million in 2017 for failing to maintain an effective AML framework between 2012 and 2015. The issues stemmed from weak oversight of new customer relationships and inadequate controls over global business booked through the UK as emphasized in the article - FCA fines Deutsche Bank £163 million for serious anti-money laundering controls failings | FCA

Course Outline

Money Laundering

- Ill-effects of Money Laundering

- Money Laundering Cycle

- Three stages:

- Placement

- Layering

- Integration

- Three stages:

Combating or Countering the Financing of Terrorism or CFT

Tax avoidance vs Tax evasion

Tax avoidance vs Tax evasion

Who is the MLRO?

AML Risk Indicators

Legal and Regulatory Framework

KYC Requirements and Risk-Based Approach

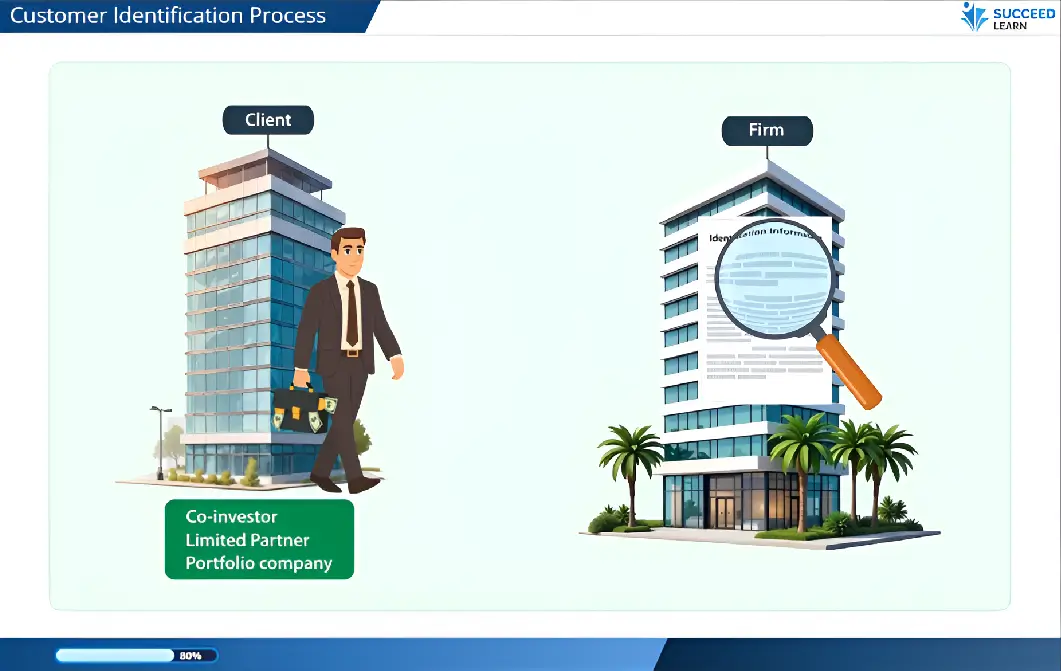

KYC

Risk-Based Approach

- Four-step KYC process:

- Perform Customer Identification Process (CIP)

- Perform Client Due Diligence (CDD) or Enhanced Due Diligence (EDD)

- Approve or reject deals and investments

- Conduct periodic reviews

Reporting And Prevention of Money Laundering

FAQs

PE and VC firms operate in a high-risk environment involving large capital flows, complex structures, offshore entities, and cross-border transactions. Training helps employees spot red flags such as hidden ownership, unexplained offshore funds, rushed deal approvals, and inflated valuations, preventing criminal funds from entering the firm and ensuring regulatory compliance and follow the correct reporting procedures.

The course covers key financial crime risks:

- Money Laundering (AML) – identifying illicit funds in deal flows.

- Terrorist Financing (CFT) – recognising transactions that may fund extremist activities.

- Proliferation Financing (CPF) – detecting risks tied to dual-use technologies and sanctioned entities.

These risks often surface subtly in PE/VC deals, making awareness critical.

Yes. It explains major AML regulations across the UK and US including POCA, MLR 2017, the Bank Secrecy Act, and the USA PATRIOT Act. Employees learn what regulators expect such as CDD/EDD obligations, sanctions compliance, SAR reporting and anti-tipping-off requirements.

Absolutely. The course can incorporate your org’s AML policies, escalation pathways, high-risk customer types, reporting templates, and sector-specific scenarios.

Learners will be able to:

- Identify red flags across investor onboarding, fund flows, and deal structures.

- Conduct KYC, CIP, CDD, and EDD checks properly.

- Assess risk using a structured, risk-based approach.

- Escalate suspicious activity to the MLRO without tipping off clients.

- Make informed decisions on approving or pausing deals based on risks.

Employees learn when and how to escalate concerns to the Money Laundering Reporting Officer (MLRO). The course explains MLRO responsibilities - reviewing internal reports, filing SARs, overseeing AML controls - and clarifies that discussing suspicions with anyone else is considered “tipping off,” a criminal offence.

By enabling employees to identify suspicious activity early - such as opaque ownership, offshore routing, unusual urgency, or irrational valuations - the course helps firms block high-risk relationships before they escalate into regulatory breaches or public scandals.

No. While banks and financial institutions are high-risk sectors, AML obligations extend across fintech, insurance, real estate, accounting, gaming, e-commerce, legal services, and any org handling large volumes of financial transactions.

The course includes interactive scenarios, case studies, red-flag identification exercises, drag-and-drop activities, and regular knowledge checks to reinforce learning.

Yes. Employees receive a completion certificate after passing the final assessment, supporting your compliance records and audit requirements.

The course typically takes 40 mins to complete and is self-paced. It can be completed in short modules, allowing employees to learn without disrupting business operations.

Yes. It features real-world AML case studies such as Azerbaijani Laundromat case (2012–2014) where nearly $3 billion was channelled through four UK-based shell companies and in the Danske Bank Estonia scandal (2007–2015), an estimated €200 billion in suspicious funds flowed from high-risk jurisdictions like Russia, Azerbaijan, and the British Virgin Islands.

By training employees on AML risks, procedures, and escalation protocols, your org can demonstrate “reasonable steps,” maintain strong audit trails, and show regulators that you have an effective, ongoing AML programme.

The delivery is fully flexible. If you have an in-house LMS, we can provide the course as a SCORM-compliant package. If not, we offer a seamless SaaS-based hosting option for easy access and deployment.