- Animated Videos simplifying complex AML, terrorist financing concepts

- Short slides with narrated text delivering clear explanations of KYC, CDD, EDD, PEPs

- Interactive scenario exercises

- Real-life case examples illustrating how financial crime risks arise in everyday business transactions

- Frequent knowledge checks / quizzes reinforcing understanding and validating learning

- Final assessment / certificate generation

Learning Objectives

By the end of this course, learners will be able to:

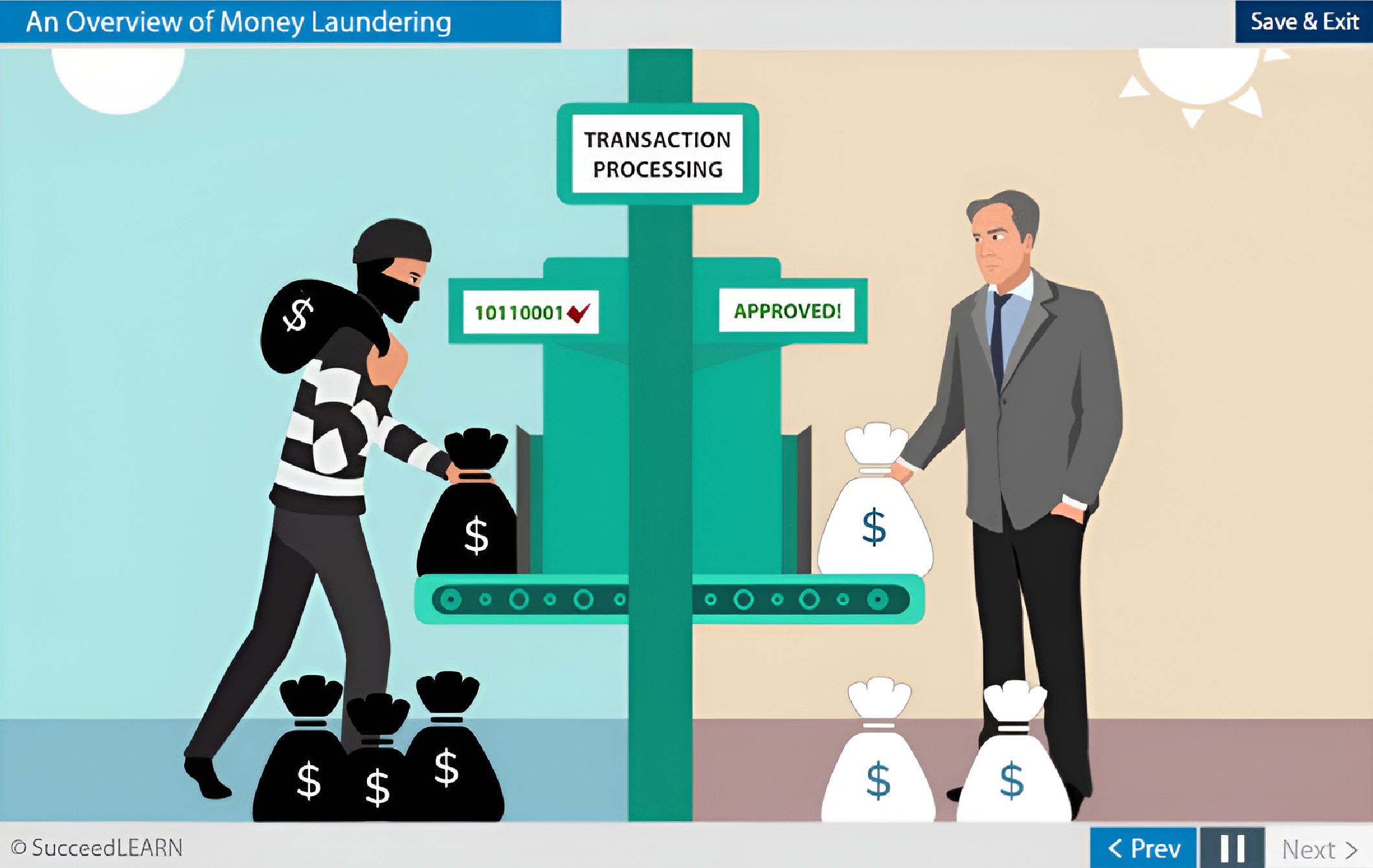

- Define money laundering and explain how it works

- Define terrorism and terrorist financing

- Distinguish between money laundering and terrorist financing

- Define the KYC requirements and explain the risk-based approach to anti-money laundering and countering financing of terrorism

- State the laws that govern Anti-Money Laundering and Countering the financing of terrorism

- Identify the behaviours that may indicate money laundering activities

- Summarize the duties and responsibilities of Financial Action Task Force

- Report and reduce AML risk

Why Anti-Money Laundering (AML), Combating Financing of Terrorism (CFT) eLearning Training?

Reduces enterprise-wide legal, financial, and criminal exposure

Employees are explicitly made aware that failure to report suspicious activity or “tipping off” can result in individual and corporate liability. By clarifying employee obligations and escalation protocols, the course reduces the likelihood of breaches that could lead to fines, license restrictions, asset forfeiture, or criminal prosecution.

Strengthens frontline risk detection across business functions

Through sector-specific red flags, scenario-based decision-making, and real-world examples (including real estate and third-party transactions), the training empowers employees to recognise suspicious patterns early—before they escalate into systemic compliance failures.

Supports a risk-based AML/CFT framework in practice

The course operationalises the risk-based approach by clearly explaining KYC, CDD, EDD, PEP identification, sanctions screening, and customer risk categorisation. This ensures employees understand why enhanced controls are required for high-risk customers, jurisdictions, or transaction types, reducing inconsistent application of controls.

Scenario-driven, decision-based learning

Realistic workplace scenarios and judgement-based questions train employees to apply AML principles in real situations, not just memorise definitions.

Assessment-backed certification for audit evidence

Knowledge checks and final assessments provide measurable proof of understanding and training completion.

Laws & Regulations Addressed in AML, CFT Compliance Training

| Legislation / Concept | Relevance in the Course |

|---|---|

| UK: Proceeds of Crime Act 2002 (POCA) Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017 (as amended) | Forms the backbone of AML obligations in the UK. The course explains money laundering offences, employee liability, suspicious activity reporting (SARs), and the prohibition on tipping off. Also covers KYC, CDD, EDD, PEP identification, risk-based approach, and ongoing monitoring. The course operationalises these requirements through scenarios and red-flag identification. |

| EU EU Anti-Money Laundering Directives EU Terrorist Financing Regulations | The course aligns with EU requirements on beneficial ownership, risk-based controls, criminal liability, and cross-border cooperation. Also highlights detection of suspicious funding patterns and escalation expectations. |

| US Bank Secrecy Act (BSA) USA PATRIOT Act Anti-Money Laundering Act of 2020 OFAC Sanctions Regulations | Establishes core AML obligations in the US. The course explains monitoring, reporting of suspicious activity, and the role of employees in identifying red flags, reinforces employee responsibilities in customer onboarding and escalation, emphasises screening against US sanctions lists and understanding the serious civil and criminal penalties for violations. |

Course Structure

Learning elements

Format & accessibility

Designed for use across desktop, tablet, and mobile devices, the solution features a centralised learner dashboard, real-time progress tracking, automated learner reminders, and smooth integration with your existing LMS or HR systems.

Certificate

On successful completion and passing the assessment, learners can generate a completion certificate as proof of training (configurable per org).

Target Audience

The Anti-Money Laundering (AML) & Combating Financing of Terrorism (CFT) Training is tailored for:

- Client-facing and transaction-handling employees

- KYC, due diligence, and onboarding teams

- Compliance, risk, and audit professionals

- Managers with AML oversight responsibilities

- Employees dealing with third parties or cross-border activity

- New joiners and staff requiring AML refresher training

Case Studies: Real Consequences of Non-Compliance

AML & CFT training is a regulatory expectation, an audit requirement, and a risk-control necessity, making it essential for orgs operating in today’s compliance environment. Following are few cases where companies were fined for non-compliance:

- TD Bank – Approximately $3 billion (2024): U.S. and Canadian regulators imposed a multi-billion-dollar penalty on TD Bank for systemic AML compliance failures. Regulatory findings pointed to weak governance and ineffective compliance controls, including employees’ inability to effectively detect, escalate, and report suspicious activity - deficiencies that ongoing training would help mitigate

- Santander UK – £108 million (2022): The UK Financial Conduct Authority fined Santander for prolonged failure to maintain effective AML controls, particularly in verifying customer information and detecting suspicious activity. These failures reflect broader compliance weaknesses where insufficient employee training likely contributed to inadequate execution of KYC and monitoring obligations.

Course Outline

Why is it important for you to take up this course?

An overview of Money Laundering

Ill Effects of Money Laundering

Money Laundering Cycle

- Placement

- Layering

- Integration

Countering the financing of terrorism

Difference between Money Laundering and Terrorist Financing

KYC Requirements and Risk-based approach

- KYC

- Risk-based approach to AML/CFT

- Customer Identification Process (CIP)

- Client Due Diligence (CDD) and Enhanced Due Diligence (EDD)

- Approve or reject applications

- Annual Review

Recognising Money Laundering

Scenario: Some ‘red flag’ scenarios that carry an above-average risk for money laundering to occur.

Reporting and Prevention of Money Laundering Activities

Total Duration: 1 Hour

FAQs

AML and CFT laws place responsibility on orgs to reduce risks of AML, detect, and report financial crime. This training equips employees to recognise red flags, follow due-diligence processes, and escalate concerns correctly, helping the org demonstrate reasonable steps to support detection and reporting of money laundering and terrorist financing.

In most jurisdictions, the training is not mandatory. However, regulators explicitly require orgs to ensure employees are adequately trained on AML/CFT risks. In enforcement actions, lack of structured training is often cited as a compliance failure, making training a regulatory expectation in practice.

The course is suitable for:

- Client-facing employees

- Operations, finance, and onboarding teams

- Compliance and risk personnel

- Senior management and decision-makers

Any employee who may encounter customers, third parties, payments, or transactions with financial crime risk should complete the training.

The course trains employees to:

- Identify suspicious behaviour and transactions

- Apply KYC, CDD, and EDD correctly

- Understand PEP and sanctions risks

- Avoid tipping off

- Report concerns through appropriate channels

This reduces the likelihood of regulatory breaches, fines, reputational damage, and operational disruption.

Yes. The course includes scenario-based exercises and case-style examples covering:

- Client onboarding and due diligence

- High-risk jurisdictions and cash transactions

- Third-party confirmations and reliance risks

- Unusual payment structures and settlement behaviour

These scenarios help employees apply AML principles in day-to-day work.

The training clearly explains:

- Customer Identification Process (CIP)

- Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD)

- Risk scoring and monitoring

- Identification of Politically Exposed Persons (PEPs)

This ensures employees understand why controls exist and how to apply them consistently.

Upon completion, employees must pass a final assessment. Certificates of completion provide documented evidence of training, supporting:

- Regulatory inspections

- Internal and external audits

- Licensing or renewal processes

- Demonstration of compliance culture and governance

Best practice and regulator expectation is regular refresher training, typically annually or when:

- Risk exposure changes

- Laws or internal policies are updated

- Employees move into higher-risk roles

This course supports ongoing compliance and refresher requirements.

Yes. The training explicitly explains that employees may be held liable for:

- Failing to report suspicious activity

- Tipping off

- Knowingly or unknowingly facilitating illegal transactions

This reinforces accountability and encourages correct escalation behaviour.

The course aligns with internationally recognised AML principles, including FATF expectations, making it suitable for orgs operating across multiple jurisdictions or dealing with cross-border clients and transactions.

The delivery is fully flexible. If you have an in-house LMS, we can provide the course as a SCORM-compliant package. If not, we offer a seamless SaaS-based hosting option for easy access and deployment.